Watch This Video If You Need A Tax Strategy For Moving To Spain

Make Sure You Know About Potential Tax Implications

Be Mindful Of Potential Issues With Your Structures

Be Sure To Consult With A Professional BEFORE Making The Move

If You Need Help Filing Form 706-NA

Without Potential Mistakes & Fines

Shorten The Waiting Time

With A Professional Doing it FOR YOU

Simplifying Form 706-NA: A Comprehensive Guide for Non-Resident Aliens

Part 1

Introduction

In this article, we’ll explore obtaining the IRS transfer certificate and explain how Form 706NA and form 5173 apply to these cases. Obtaining the IRS transfer certificate

is a crucial step in the process of handling estates with non-resident aliens. Form 706 NA is the United States Estate (and Generation-Skipping Transfer) Tax Return for estates of

non-resident non-citizens, while Form 5173 is the request for a certificate of release of a federal estate tax lien. Understanding the intricacies of these forms is essential for ensuring

a smooth and compliant transfer of assets. This article will provide a comprehensive guide, shedding light on the nuances of these processes and helping you navigate the

complexities of estate management for non-resident aliens.

Part 2

Introduction to IRS Transfer Certificate and Form 706 NA

When a non-US Person passes with US situs financial assets, it often creates issues for descendants.

1. They are unable to access the accounts until they have an IRS Transfer Certificate.

2. They cannot get an IRS Transfer Certificate until they have a closing letter.

3. They cannot get a closing letter until they file the Form 706 NA

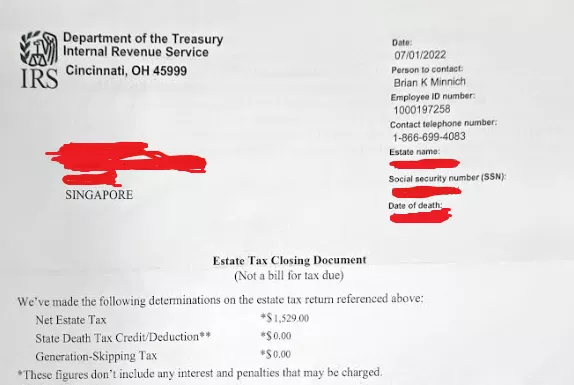

This is what a Closing Letter looks like

Let’s go through this step by step

The purpose of Form 706-NA

Internal Revenue Code (IRC) § 2101 imposes a transfer tax on the estate of any non-resident, non-citizen, of the U.S. Form 706-NA , United States Estate (and Generation Skipping

Transfer) Tax Return, is used to compute estate- and generation-skipping transfer (GST) tax liability for all non-resident alien decedents. Form 706NA must be filed within nine

months of the date of the decedent’s death. The taxpayer can request an automatic six-month extension by filing Form 4768 by the original due date. If Form 706 NA is not

promptly filed, or the tax payment is not remitted by the original due date, penalties will be levied against the estate.

Form 706-NA is used to compute estate and generation-skipping transfer (GST) tax liability for nonresident not a citizen (NRNC) decedents. The estate tax is imposed on the

transfer of the decedent’s taxable estate rather than on the receipt of any part of it.

For information about transfer certificates for U.S. assets, write to the following address.

Internal Revenue Service

Attn: E&G, Stop 824G

7940 Kentucky Drive

Florence, KY 41042-2915

Note:

In order to complete this return, you must obtain Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, and its instructions. You must attach schedules

from Form 706 if you intend to claim a marital deduction, a charitable deduction, a qualified conservation easement exclusion, or a credit for tax on prior transfers, or if you

answer “Yes” to question 5, 7, 8, 9a, 9b, or 11 in Part III. General Information. You will need the Instructions for Form 706 to explain how to value stocks and bonds. Make sure

that you use the version of Form 706 that corresponds to the date of the decedent’s death.

Who must file Form 706-NA

Form 706-NA applies only to non-resident alien decedents – individuals whom, upon their death, are not U.S. residents or citizens. For purposes of determining estate and gift tax,

residency is not determined by the residency rules for income-tax purposes (Sec. 7701(b)(6)). For estate and gift-tax purposes, U.S. residency requires physical presence at some

place in the U.S., and the intention to make that place a fixed and permanent home (Christina de Bourbon Patino, 51-1 USTC ¶9123 (4th Cir.), aff’g, 13 T.C. 816 (1949)). If the

facts and circumstances support the preceding notion of residence, the executor of the decedent’s estate must file Form 706.

The executor of a non-resident alien decedent’s estate must file Form 706-NA if the date-of-death value of the gross estate located in the U.S. exceeds the filing limit of $60,000.

The executor must file Form 706-NA if the date of death value of the decedent’s U.S.-situated assets, together with the gift tax-specific exemption and the amount of adjusted

taxable gifts, exceeds the filing threshold of $60,000. The gift tax-specific exemption refers to the amount allowed for gifts made by the decedent between September 9, 1976, and

December 31, 1976, inclusive. The amount of adjusted taxable gifts refers to the amount of adjusted taxable gifts made by the decedent after December 31, 1976.

Form 706 NA: United States Estate (and Generation-Skipping Transfer) Tax Return must be used to figure out the generation-skipping transfer tax (GSTT) liability for estates of

non-residents of the United States. The generation-skipping tax is levied upon the transfer of the decedent’s estate rather than when it is received by a beneficiary.

A non-resident is someone who does not live in the United States and is not a citizen. The IRS has specific rules for how a person meets the criteria of a resident. Taxpayers

are considered residents if they meet the green card test or if they fulfill the substantial presence test in the United States. Individuals who do not satisfy these requirements are

considered non-residents.

U.S.-based assets that are considered part of an estate include things like:

.Real estate

.Physical personal property

.Securities of U.S. companies

.Debt obligations within the U.S

.Bonds4

One important point to note is that any American-based stocks would be subject to U.S. estate taxes even if the certificates were physically stored outside of the country.

Important:

Although Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return must be filed within nine months following the person’s death, you may request a six-

month deadline extension. This would allow the estate a total of 15 months to submit its tax return paperwork. Failure to file and remit payment on time may result in fines and

penalties.

When To File Form 706NA

File Form 706-NA within 9 months after the date of death unless an extension of time to file was granted.

If you are unable to file Form 706-NA by the due date, use Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping

Transfer) Taxes, to apply for an automatic 6-month extension of time to file. If you have already received a 6-month extension and are an executor who is out of the country, you

may apply for an additional extension of time to file by filing a second Form 4768 and completing the form and attaching a written statement of explanation as instructed. For

both extensions, check the “Form 706-NA” box in Part II of Form 4768.

US Estate Tax, the IRS & Form 706-NA

Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return is a tax form used to calculate tax liabilities for the estates with U.S.-based assets and generation-

skipping transfers of non-resident decedents. Form 706-NA, which is distributed by the Internal Revenue Service (IRS), must be filed nine months after the death of the individual

by their executor if the estate’s value exceeds the filing threshold of $60,000.

Determining the taxable estate

Gross estates of non-resident aliens with property located in the U.S., and valued at $60,000 or more, might be subject to estate tax. This is before taking into account any

“allowable deductions” or estate-tax treaties between the U.S. and the non-resident alien’s home country. The value of the decedent’s gross assets is determined at the date of the

decedent’s death or, six months later, on the alternate valuation date.

Property located in the U.S., allowable deductions and credits

For real estate and tangible personal property, “located in the U.S.” is determined by physical presence in the U.S. (regardless of where the owner resides). If a non-resident alien

buys stock in a U.S. corporation (e.g., General Electric), the stock is considered located in the U.S., regardless of where the stock certificates are held. Furthermore, any debt

obligations that a U.S. citizen, corporation or governmental agency issues to a non-resident alien are treated as gross assets, which need to be included within the decedent’s gross

estate.

From their gross assets, the decedent’s estate is entitled to deduct any and all “allowable deductions.” These include charitable contributions to U.S. charities designated as such by

the IRC. The decedent’s estate also is entitled to certain expenses, losses, indebtedness or taxes incurred by the estate. These expenses must be prorated by the U.S.-share of the

decedent’s worldwide estate. Assuming the decedent is not married to a U.S. resident, one deduction that is not allowed to a non-resident alien is the marital deduction, unless it

meets the provisions of a Qualified Domestic Trust (Sec. 2056).

Non-resident aliens are entitled to a unified credit of $13,000, reduced by any lifetime gifts. Non-resident decedents whose gross assets are less than $60,000 upon their death may

still have to file a Form 706-NA if they have used any part of the $13,000 unified credit during their lifetime.

Treaty versus non-treaty countries

When determining a non-resident decedent’s tax liability, the estate must take into account whether the decedent resided in a country governed by an estate-tax treaty with the U.S.

If the non-resident alien is from a treaty-based country, he or she must attach a statement to Form 706-NA indicating the return was prepared based on a treaty with the U.S. (Reg.

Sec. 301.6114-1). Non-treaty based estate tax returns (i.e., Form 706-NA) are governed by the estate-tax provisions for non-resident aliens in IRC § 2101-2108.

USA

When determining a non-resident decedent’s tax liability, the estate must take into account whether the decedent resided in a country governed by an estate-tax treaty with the U.S.

If the non-resident alien is from a treaty-based country, he or she must attach a statement to Form 706-NA indicating the return was prepared based on a treaty with the U.S. (Reg.

Sec. 301.6114-1). Non-treaty based estate tax returns (i.e., Form 706-NA) are governed by the estate-tax provisions for non-resident aliens in IRC § 2101-2108.

How to File Form 706-NA

Executors of estates that would be required to complete Form 706NA must file a tax return if the fair market value (FMV) of the “U.S.-situated assets, together with the gift tax

specific exemption and the amount of adjusted taxable gifts, exceeds the filing threshold of $60,000.”6 In some cases, estates may still be required to file a tax return even if the

estate value is less than that, namely if the deceased made large lifetime gifts of U.S. assets that took advantage of the unified credit exemption.

Several countries have death tax treaties with the United States, and executors reporting information on an estate from one of those countries may have to attach a statement stating

that the death tax treaty is being applied.1

This form has been revised and updated numerous times since 1962. Form 706-NA is available to taxpayers by requesting Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return.2 Citizens of U.S. possessions, such as the U.S. Virgin Islands, are not considered citizens in Form 706-NA.1

How To Complete Form 706-NA

Complete Form 706-NA in this order.

1.Part I

2.Part III

3.Schedule A and B

4.Part II.

The estate tax is imposed on the decedent’s gross estate in the United States, reduced by allowable deductions. Figure the gross estate in the United States on Schedule A. Reduce the Schedule A total by the allowable deductions to derive the taxable estate on Schedule B, and figure the tax due using

Part II. Tax Computation.

Download Form 706-NA

Here is the IRS link, which includes instructions as well as the downloadable Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return.

Private delivery services (PDSs)

You can use certain PDSs designated by the IRS to meet the “timely mailing as timely filing/paying” rule for tax returns and payments.

Where To File

File Form 706-NA at the following address.

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

If using a PDS, use this address.

Internal Revenue Submission Processing Center

333 W. Pershing

Kansas City, MO 64108

Penalties

Section 6651 provides for penalties for both late filing of returns and late payment of tax unless there is reasonable cause for the delay. There are also penalties for willful attempts

to evade or defeat payment of tax.The law also provides for penalties for valuation understatements that cause an underpayment of tax. See sections 6662(g) and (h) for more

details.

Reasonable-cause determinations

If you receive a notice about penalties after you file Form 706-NA, send an explanation, and we will determine if you meet reasonable-cause criteria. Do not attach an explanation

when you file Form 706-NA. Explanations attached to the return at the time of filing will not be considered.

Return preparer

Estate tax return preparers who prepare any return or claim for refund that reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal

to the greater of $1,000 or 50% of the income earned (or to be earned) for the preparation of each such return. Estate tax return preparers who prepare any return or claim for

refund that reflects an understatement of tax liability due to willful or reckless conduct are subject to a penalty of $5,000 or 75% of the income earned (or income to be earned),

whichever is greater, for the preparation of each such return. See section 6694(a) and 6694(b), the related regulations, and Announcement 2009-15, 2009-11 I.R.B. 687.

Death Tax Treaties

Death tax treaties are in effect with the following countries.

Australia

Ireland

Austria

Italy

Canada*

Japan

Denmark

Netherlands

Finland

South Africa

France

Switzerland

Germany

United Kingdom

Greece

*Article XXIX B of the United States–Canada Income Tax Treaty

If you are reporting any items on this return based on the provisions of a death tax treaty or protocol, attach a statement to this return indicating that the return position is treaty

based. See Regulations section 301.6114-1 for details.

What to do when the Form 706-NA is submitte1 Columnd

So once the Form 706 NA is submitted within 9 months of the passing, it takes a while to be processed. Sometimes 6 months or more.

We have had issues where the estate tax check is cashed by the IRS but the funds are posted to some sort of suspense account as opposed to being matched to the correct taxpayer

account. We then need to contact the IRS international line on 267-941-1000 where we are given another number such as +18593203456. On this second number, callers are

invited to leave a message on the voice mail as the mailbox is cleared daily. However, there are times when the mailbox is unavailable. So we need to send an email to the IRS to

ensure that the check is matched to the correct return – sbse.eg.intl (at) irs.gov

If everything goes well, the IRS may issue a letter explaining that it was processed. Sometimes it may not send any letter so one would need to contact them accordingly. If they

send a letter, they may issue a temporary tax ID to use when communicating with them

Then the next step is to contact the IRS to request a Transfer Certificate. Here’s the process for requesting the Transfer Certificate is as follows –https://www.irs.gov/businesses/small-businesses-self-employed/transfer-certificate-filing-requirements-for-the-estates-of-nonresidents-not-citizens-of-the-united-states

Estates and their authorized representatives may request an account transcript by filing Form 4506-T, Request for Transcript of Tax Return. Currently, Form 4506-T can be filed

with IRS via mail or facsimile (per the instructions on the form). Although account transcripts for estate tax returns are not currently available through IRS’s online Transcript

Delivery System (TDS), the IRS website, www.irs.gov, will have current information should an automated method become operational.

To allow time for processing the estate tax return, requests should be made no earlier than four months after filing the estate tax return.

The IRS says that estates and their authorized representatives who wish to continue to receive estate tax closing letters may call IRS at (866) 699-4083 to request an estate tax

closing letter no earlier than four months after the filing of the estate tax return.

Instead of securing a closing letter to send with the request for a transfer certificate, it is now possible to send a transcript –https://www.irs.gov/businesses/small-businesses-self-employed/transcripts-in-lieu-of-estate-tax-closing-letters

So in summary, you need:

1. To call the IRS at (866) 699-4083 to request an estate tax closing letter

2. Request a transcript of the tax return by using a Form 4506-T – https://www.irs.gov/forms-pubs/about-form-4506-t

or https://www.irs.gov/businesses/small-businesses-self-employed/transcripts-in-lieu-of-estate-tax-closing-letters

You need to verify that any examination has been completed. Once you have one of these items use it to send a formal request for Form 5173 or Transfer Certificate using the

following address:

Internal Revenue Service

Attn: E&G, Stop 824G7940

Kentucky Drive

Florence, KY 41042-2915

Key Takeaways

.Form 706-NAis used to calculate tax liabilities for estates of individuals with U.S.-based assets that are part of their estate who are not citizens.

.U.S.-based assets that would be considered part of an estate include things like real estate, physical personal property, and securities related to U.S. companies.

.Executors of estates that would be required to complete Form 706-NA must file a tax return if the fairmarket value of the estate was at least $60,000.

.The form must be filed within nine months of the death of the individual.

.The generation-skipping tax is imposed when the decedent’s estate is transferred rather than upon receipt of the beneficiary.

Our US Tax Consulting Firm Has Been Featured On:

Our American tax service has been in practice since 1980

What Is A Reduced-Fee Initial Consultation?

We provide consultations at a reduced fee, aimed to be both educational and enlightening.

During your consultation, our focus is not on selling rather on conducting an assessment of your situation.

Should you be interested in proceeding with our services at the end of our discussion, we will present you with a quote.

The fee for your initial consultation will be credited towards your engagement fee should you decide to engage our services.

Once your consultation is scheduled, we will provide you with the link to your zoom call to your consultation.

HTJ.Tax (a member of Moores Rowland) provides a range of professional taxation services catering primarily to anyone with US Tax exposure.

Our specialist Team focuses exclusively on offshore tax matters worldwide.

About Us

Derren Joseph has successfully completed the Comparative Tax Program at Harvard University and is an EA (Enrolled Agent).

As an EA, he has been admitted to practice before the Internal Revenue Service (IRS) to represent taxpayers in all 50 states and internationally.

He has 2 Masters Degrees in Economics and a Certified Diploma from the ACCA (Association of Chartered Certified Accountants in the UK).

Derren has also done Executive Education with Columbia Business School in New York City, and has completed Advanced Tax coursework at both New York University and the University of London.

He is:

• Chair of the Tax Working Group for Moores Rowland in the Asia Pacific (offices in 18 countries)

• Chair of the Asian Branch of the International Business Structuring Association.

• A member of the Briefing Group advising The Rt. Hon. The Lord Mayor of the City of London on current and emerging international tax issues.

He had his views published in the Singapore Business Review, Forbes Asia, and the American Chamber of Commerce in Indonesia, the International Business Structuring Association (in the UK), Offshore Alert, and the (Trinidad) Guardian. And has given “in person” seminars on tax issues in the U.S., the U.K., Singapore, Indonesia, Spain, Malaysia, Vietnam, The Philippines, Portugal, Hong Kong, the UAE, and the Caribbean.

Derren enjoys writing and has published 3 books on taxation, one of which was an Amazon Best Seller in 2020.

Why We Don’t Offer Free Consultations?

Sorry but we do not offer free introductory calls. Yes - we are aware that many of our competitors do offer free introductory calls but here’s my honest explanation as to why we do not.

Our approach to consultations is direct and personal.

In our initial 60-minute consultation, we can evaluate your situation and offer crucial insights to guide your next steps.

It’s purely informational, with no sales tactics involved.

Regardless of whether you choose to engage our firm further, our initial consultation aims to enlighten you about your options.

While it doesn’t encompass document review or follow-up summary services beyond the scope of a typical 60-minute consultation for those seeking in-depth analysis, our firm offers comprehensive tax services.

A thorough document review consultation could entail significant expense, often requiring several hours to provide detailed insights.

Here are three (3) reasons we do not offer free calls -

1. It is mathematically impossible. We get a large number of enquiries daily via our website (https://htj.tax), our podcast feedback forms (we publish daily on over 20 podcast platforms), our YouTube channel, LinkedIn (I have nearly 30,000 connections on LinkedIn), Facebook, Instagram and TikTok. It is mathematically impossible to offer free introductory calls to everyone that asks for one.

2. Information overload. In my initial email to prospects, we provide a comprehensive introduction to who we are. There’s a capability statement, introductory video, and even a link to my bio, the 3 books I’ve published (including 1 Amazon best seller), over 1500 videos and 2500 articles. Some of which were published in Forbes Magazine, the Singapore Business Review, Offshore Alert, The Guardian etc. It would be quite difficult to disclose anything about myself and my team that you cannot glean from the information I provided.

3. The selling game. Usually an initial free call is with a sales person whose role is really to close a paid engagement. As you already know, in this world, nothing is free. So inevitably the cost of that salesperson needs to be built into the price eventually paid. If you get a free introductory call with an expert? That expert would logically hold back on the initial call…they cannot afford to give away the secret sauce for free. In short it is usually a waste of both our time.

So here’s our honest position. If after reviewing who we are, and what we can do, you do not see our value? Then it makes sense for you to move onto another team offering a better fit to your needs.

But our door will always be open. Do keep in touch and let us know if we can work together in the future!

If You Have Any Questions About Moving From The US To Spain

Review Of All Of Your Assets And Income Streams

Explanation On The Tax Treatment

Advice On Mitigation Strategies

Review Of All Of Your Assets And Income Streams

International Cross Border Taxation Strategies

All Your Questions Answered

Our Results:

739+

Estimate of Successful

Streamlined Cases

100+

5-Star

Ratings

7663+

Estimate of

Clients Served

2000+

Articles

Published

1000+

Educational Videos &

Podcasts Published

7

Primary

Locations

35

Affiliate

Offices

55+

Professional

Staff

This Is What Our Clients Say:

Continually Delivers is the phrase that comes to mind when I think about Derren. I've come across a lot of knowledgeable tax specialists in the past but where Derren differentiates himself from the pack is the way he can take his understanding of complex issues and transfer them in a way clients can comprehend and appreciate. I will continue to use Derren with clients that need additional support in the tax arena any chance I get and I look forward to frequently using him going forward.

Paul Cunningham, AWP, MBA (Cunningham Construction Ltd)

Derren Joseph were able to help us in our US Tax Compliance performing a detailed review of the last 9 years ensuring that all requirements of the IRS are fully satisfied. He is very helpful to our queries irregardless of the day and time. A customer service that you cannot find to any of the consultant out there. He displayed his commitment not only to the Company that he is working with but also his commitment to truly help his client have a peaceful mind knowing that there is someone looking at our back even at night....Highly recommended not only because of his credentials but also because of his professional work ethics.

Anthony Catajan (General Manager At ADEC Innovations-USA)

Derren was very highly recommended by business friends to solve my very complicated US Tax problem. From our very first meeting he was friendly and easy to understand and carefully explained what was needed initially. His patience with me and my hearing problem was amazing. Throughout he described, in detail, the individual results of his review from the mountain of files. Derren was very efficient and professional during the entire period. He was immediately available and forthcoming of any and all questions. His knowledge of IRS requirements and regulations is supreme. He produced the final results on IRS forms much sooner than expected. I highly recommend Derren for any US Tax matters.

Foster T Manning (Retired)

Derren has made my life easier as a US expat living overseas. I haven’t lived in the US since the 80’s, and have run businesses in France and Singapore. Derren has helped eliminate a great deal of burdens and worries for me.

Aneace Haddad (Executive Coach, ICF-PCC

Hi Derren, Really appreciate your work for me re-claiming withholding tax in USA. Great Job. Many Thanks Brian

Brian Dobson (Managing Director)

Excellent service from Derren, he answered all questions quickly and thoughtfully pertaining my situation. I would highly recommend him for tax returns to the USA! Thanks again.

Jason Rutkauskas (Chiropractor At Align Chiropractic Singapore)

Derren has made my life easier as a US expat living overseas. I haven’t lived in the US since the 80’s, and have run businesses in France and Singapore. Derren has helped eliminate a great deal of burdens and worries for me.

Aneace Haddad (Executive Coach, ICF-PCC

Derren is highly knowledgeable on US and foreign tax matters. He has strong communication and reverts with clear/definitive answers with very quick turnaround. He makes sure to keep you updated on the status and delivers requirements well in advance of deadlines. Good results delivered with an easy / client centric process.

Tim Weiss (Global Business Process Owner, Finance)

I highly recommend Derren. I have been his client for a number of years now and as an expat in Singapore have relied on his professional and timely service. He will answer immediately any question you have regarding taxes no matter how complicated (or simple) and help you navigate the process in a seamless fashion. A real professional!

Jennifer Gargiulo (University Lecturer)

If You Have Any Questions About Moving From The US To Spain

Review Of All Of Your Assets And Income Streams

Explanation On The Tax Treatment

Advice On Mitigation Strategies

Review Of All Of Your Assets And Income Streams

International Cross Border Taxation Strategies

All Your Questions Answered

HTJ.TAX is a member of Moores Rowland Asia Pacific with over 30 offices. We help international entrepreneurs and expats from The U.S., The UK, Europe, Israel and South East Asia. Get in touch with us to see how we can help you.

Follow us:

Singapore:

Hayden T Joseph CPA LLP

(Advanced American Tax Pte Ltd)

Samsung Hub #25-00

3 Church Street,

Singapore 049483

United States:

Advanced American Tax LLC

373 NE 211th Terrace,

North Miami Beach,

Florida 33179, USA

Hong Kong :

Thomas Lee & Partners

1103-5 Allied Kajima Building 138 Gloucester Road Wanchai,

Hong Kong

United Kingdom:

HTJ Tax Consulting Ltd and Hayden T Joseph CPA Limited T/A Advanced American Tax

Dowgate Hill House

14-16 Dowgate Hill

Cannon St.

London

EC4R 2SU

United Kingdom

Portugal:

HTJ Consulting Unipessoal, Lda

AV António Augusto de Aguiar, 74, R/C,

Dto., 1050-018 Lisboa,

Portugal

France:

Fiduciaire Beloeuvre et Associés 79 boulevard du Maréchal Joffre 92340 Bourg la Reine

Dubai:

HTJ International Consulting FZE

8th Floor, The Offices 4, One Central,

Dubai World Trade Centre, Dubai

Spain:

Gutierrez Pujadas & Partners

Diputació 301 Pral.1ª – 08009,

Barcelona

Spain

Contact Us:

Phone:

SG: +65 9720 1040 (Singapore office hours only)

US: +1 305 517 7991 (24/7 Hotline)

UK: +44 20 3239 5088 (24/7 Hotline)

HK: +852 8172 1040 (24/7 Hotline)

Dubai: +971 58 540 1277 (WhatsApp only)

US Fax: (888)402 2780

(RingCentral)

EMail us at: help@advancedamericantax.com

Copyright: © 2022 Company Name - All Rights Reserved.